Nowadays, businesses are recognizing the significant advantages of electronic bookkeeping compared to traditional methods. From cost savings to improved accuracy and efficiency, electronic bookkeeping offers a wealth of benefits that can positively impact a company’s finances and overall operations. In this article, we will explore the biggest advantages of electronic bookkeeping and why it has become a game-changer for businesses in the financial management landscape.

- Data is stored in electronic format, and regular backups can be scheduled to ensure that information is safeguarded in the event of hardware failure, system errors, or natural disasters.

- Automation makes it less likely to duplicate records, misplace them, or input the wrong data.

- It’s like having a company’s financial expert by your side, using their digital tools to solve all those annoying paperwork issues.

- In addition to secure storage, electronic bookkeeping allows businesses to regularly back up their financial data.

Wide Array of Integrations With Xero

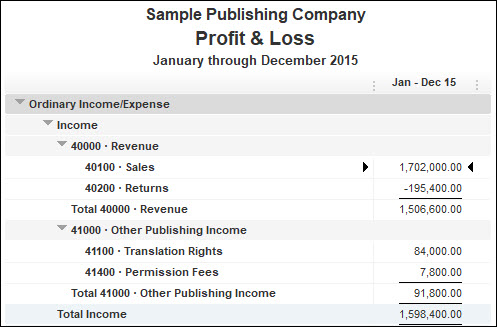

This reduces the risk of discrepancies and enables businesses to have a clear and up-to-date view of their financial health at any given time. As technology continues to evolve, the future of financial management lies in virtual bookkeeping. Businesses of all sizes can benefit http://spravconstr.ru/chugunyi/chugun-v-chushkah.html from the efficiency, accuracy, and convenience that electronic bookkeeping offers.

Streamlining Bookkeeping Services

A virtual bookkeeping company often employs a team-based approach and a peer-review process which can lead to enhanced accuracy and timeliness of deliverables. Online bookkeeping services are often more affordable than hiring an in-house bookkeeper or using a traditional accounting firm. With an in-house bookkeeping or accounting team, you will have to pay a lot more expenses when compared to online bookkeeping services.

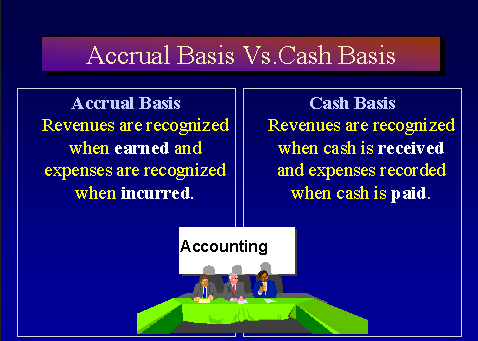

- It utilizes online accounting and bookkeeping software to simplify processes, automate tasks, and provide real time insights into a company’s financial health.

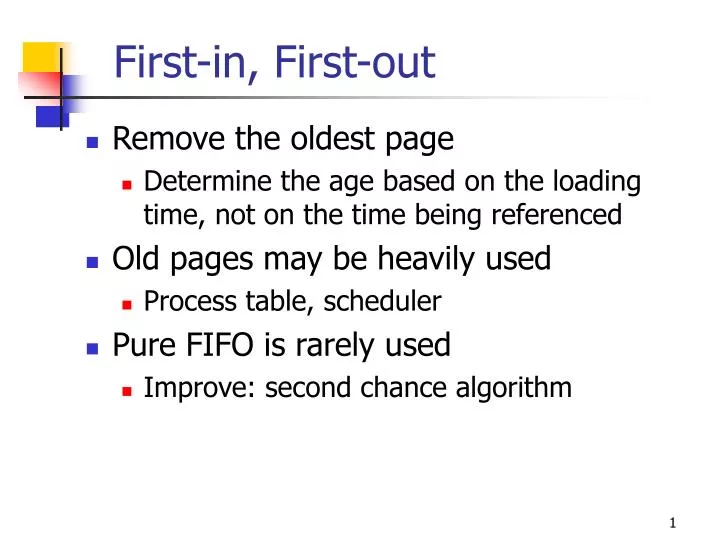

- Traditional manual bookkeeping methods often involve the physical sorting and retrieval of documents, making it challenging to obtain up-to-date financial data when needed.

- Another bonus of hiring an online accounting firm is that they exist to make their customer’s businesses run smoother.

- With all financial records stored in a searchable and easily accessible digital format, businesses can provide auditors or regulatory bodies with the necessary information quickly and efficiently.

- These integrations enhance efficiency by eliminating the need to manually transfer data between different systems, reducing duplication of work and potential errors.

Better Financial Decision-Making

Our team of experienced virtual bookkeepers is dedicated to providing accurate, efficient, and secure bookkeeping services tailored to your business needs. Contact us today to learn how we can https://maildomp.info/harnessing-the-power-of-seo-in-your-digital-marketing-strategy/ streamline your financial processes and help your business thrive with electronic bookkeeping. Furthermore, electronic bookkeeping software often offers user permission settings, allowing businesses to control access to financial information.

- The cost-saving aspect of electronic bookkeeping is evident in the reduction of paper usage, printing costs, and the elimination of manual data entry errors.

- Online bookkeeping services may not have the ability to store or process physical documents, which can be important for some businesses.

- From cost savings to improved accuracy and efficiency, electronic bookkeeping offers a wealth of benefits that can positively impact a company’s finances and overall operations.

- By using decentralized data storage and encryption, blockchain makes it much harder for hackers to alter financial records.

- Sometimes, automation comes from outsourcing accounting tasks to specialized service providers.

- Implementing software automation is often a challenging and time-consuming process.

The outside accounting firm can use data from your automated software to compile monthly, quarterly, and yearly reports. Automated bookkeeping, when done correctly, can improve real-time reporting. The better the software, the more accurate the insights, giving companies http://www.vzhelezke.ru/2009/04/16/ishhu-rabotu-v-reklame.html the capacity to analyze their revenue and expenses in real-time. Automated bookkeeping can save companies money whether they outsource accounting tasks or have an in-house team.

Accessibility and Flexibility

Digital accounting solutions integrate seamlessly with other business tools, such as point-of-sale systems, payroll, and website order fulfillment. Online bookkeeping services are helpful for all types of businesses irrespective of their size and nature. Online bookkeeping services help businesses to manage their finances in a simple manner.