For these reasons, Wave ranks as one of the best payroll software for small business. In the other states, the program is sponsored by Community Federal Savings Bank, to which we’re a service provider. Your transactions can also be synced with Wave, FreshBooks, QuickBooks, or Xero easily, saving you time on manual entry. All invoicing transactions will automatically sync with Wave Accounting, making bookkeeping a breeze. Wave currently supports four web browsers; Desktop Chrome versions 65+, Desktop Firefox versions 63+, Desktop Safari versions 11.1+, and Desktop Edge versions 17+. Mobile apps are available for both iOS 11 and later as well as Android 5 and later, with both designed to be used exclusively with mobile phones.

This accounting process generates two entries for every financial transaction. These ratings are meant to provide clarity in the decision-making process, but what’s best for your business will depend on its size, growth trajectory and which features you need most. We encourage you to research and compare multiple accounting software products before choosing one. FreshBooks has an excellent mobile app that allows you snap photos of receipts, send invoices and benefits of good bookkeeping practices track mileage.

Best Accounting Software for Small Businesses of 2024

We’re beginning to sound like a broken record, but yes, with Wave, you’ll be able to take care of your accounting and bookkeeping for free. That’s worth reiterating over and over, because it’s hard to find functional accounting software tools without ponying up for some recurring payments. Wave’s payroll feature allows you to run payroll and pay your employees and contractors with more ease than ever before. You can use the software to deposit payments into employees’ bank accounts with one click. You can also reconcile your accounts, up automatic payments, and track your invoices. In addition, the receipt scanning feature allows you to attach an image to each invoice.

Wave Accounting Key Features and Considerations

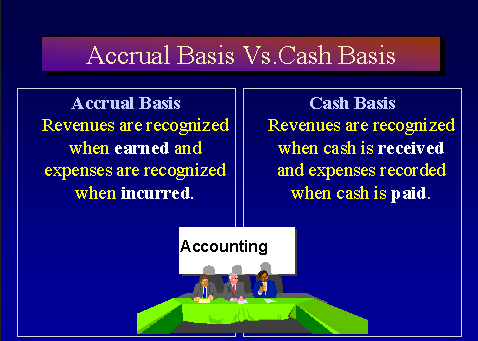

Wave Accounting gives you free unlimited invoices, users, expense and income tracking, credit and bank account connections, and more. It also offers multi-business management for no additional fee. It’s hard to beat free accounting software, especially your digital assets if you’re running a small business on a budget. Wave’s free plan offers a decent number of features, like unlimited invoices, that are not always included with other free accounting software options, let alone paid accounting software plans. It also complies with accounting standards and uses double-entry accounting, which can help ensure accuracy.

Wave Accounting Review: Key Features

- Wave is PCI Level-1 certified for handling credit card and bank account information.

- In fact, with a research score of 4.7/5, QuickBooks is our top-ranked accountancy software for small businesses.

- For example, Bookkeeping support costs $149 per month, which can be a lot for small businesses.

- The Sales feature allows you to perform a variety of functions, including preparing an estimate for a customer.

- Wave’s ability to sync all transactions to its core accounting software makes it simple and efficient to use.

If that’s not something you are interested in, you can always use the premade invoice templates and look professional. Wave accounting is a cloud-based accounting website designed for freelancers, self-employed contractors, small business entrepreneurs, and startup owners. Wave is best known for two things—its free version and ease of use. Wave accounting is free, and makes a point of its everyday usefulness for nonprofits, noting that users don’t need training as an accountant to implement it.

Our Wave accounting review finds the best things the app has going for it are its excellent features and the fact the basic software’s completely free. If you’re a startup, micro-business or sole proprietor who doesn’t want to invest in accounting software but needs to keep track of your finances, Wave Accounting is a great option. As long as you’re content with basic features and don’t see yourself expanding in the foreseeable future, you’ll find this completely free, easy-to-use software particularly appealing.

In addition, users are very pleased with the fact that invoicing features are unlimited and customizable. The paid options give you unlimited invoicing with customizable templates and payment terms, as well as unlimited income and expense tracking. Another big advantage of the app is it’s straightforward to use. The software has a clean and user-friendly interface that makes navigation simple. Even if you’ve never used accounting software before, you’ll be able to figure out Wave with ease. There’s also a dedicated invoicing mobile app to keep you going on the go.

This site does not include all companies or all available Vendors. For customers who only use our free Wave Accounting or Invoicing products, support is self-service with assistance available in the Help Center and through the chatbot, Mave. While the company does offer email and live chat support, there is no phone support available. For example, if we compare Wave vs FreshBooks, the latter provides a four-tiered subscription schedule. For example, Bookkeeping support costs $149 per month, which can be a lot for small businesses. Wave invoicing offers customizable invoices and allows you to add your branding to invoices.

What’s more, Wave doesn’t let users create cash flow projections, or any budget forecasting tools at that, making the software less suited to larger businesses that require an advanced overview of their finances. Transactions will appear in your bookkeeping automatically, and you’ll say goodbye to manual receipt entry. NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business. The best accounting software received top marks when evaluated across 10 categories and more than 30 subcategories. Learn more about how we rate small-business accounting software.

In fact, with quality free packages available, businesses don’t need to spend a dime to get started with Wave — the best value accounting software we’ve reviewed. accounting advice for startups First, Wave is remarkably customizable—especially considering that it’s, you know, free. For instance, its unlimited invoices are much more customizable (and, in our opinion, more professional-looking) than QuickBooks’ comparatively expensive invoices. You can also customize your chart of accounts (CoA) to include only the accounts you need—useful for freelancers, who tend to have fewer expense and income categories on their books than bigger businesses. Wave also doesn’t have quite as many integrations as other paid (and more popular) accounting software options. Most importantly, it doesn’t sync with any third-party payroll providers.